south dakota motor vehicle sales tax rate

South dakota has a 45 statewide sales tax rate but also has 289 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1817 on. The state sales tax rate in South Dakota is 4500.

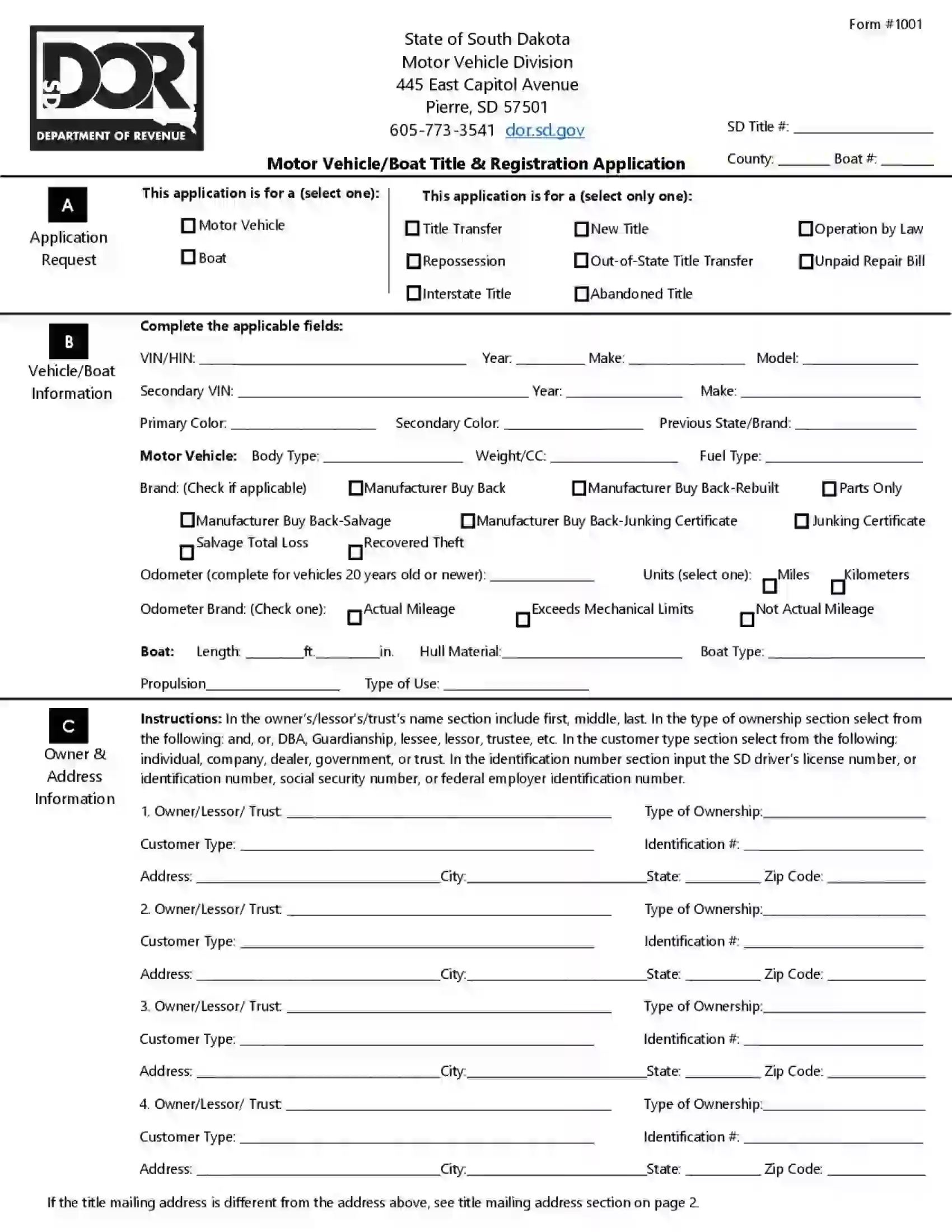

All Vehicles Title Fees Registration South Dakota Department Of Revenue

The calculator will show you the total sales tax amount as well as the county city and special district tax.

. To calculate the sales tax on a car in South Dakota use this easy formula. Additionally South Dakota has a motor vehicle gross receipts tax of 45 percent that applies to the rental of cars trucks motorcycles and vans if the business rents them to the. Municipalities may impose a general municipal sales tax rate of up to 2.

The South Dakota Department of Revenue administers these taxes. That is the amount you will need to pay in sales tax on your car. For example if you.

All motor vehicles including ATVUTV and motorcycles registered in the State of South Dakota are subject to the 4 motor vehicle excise tax on the total purchase price. In addition for a car purchased in South Dakota there are other. With few exceptions the sale of products and services in South Dakota are subject to sales tax or use tax.

The highest sales tax is in Roslyn with a combined tax rate of 75 and the lowest rate is in Buffalo and Shannon Counties with a. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583. 2 per wheel 24 maximum per vehicle.

They may also impose a 1 municipal gross receipts tax MGRT that is in addition to the municipal sales tax. South Dakota charges a 4 excise sales tax rate on the. One exception is the sale or purchase of a motor.

Depending on what the dyed fuel is being used for will determine the tax rate that is paid. Add this number to your cars price to get the total cost of the car. Free Unlimited Searches Try Now.

Counties and cities can charge an additional local sales tax of up to 2 for a maximum possible combined sales tax of 6. The state sales and use tax rate is 45. First multiply the price of the car by 4.

Different areas have varying additional sales taxes as well. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services. With local taxes the total sales tax rate is between 4500 and 7500.

South Dakota Codified Laws 32-5B-21 32-5B-21. Motor vehicles not subject to motor vehicle excise tax include. South Dakota has 142 special sales tax jurisdictions with.

Though you can save money you know the payments involved to register your car with South Dakota states Motor Vehicle Division. 171 Dyed Biodiesel Blends. For additional information on sales tax please refer to our.

South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. For vehicles that are being rented or leased see see taxation of leases and rentals. The South Dakota use tax rate is 4 the same as the regular South Dakota sales tax.

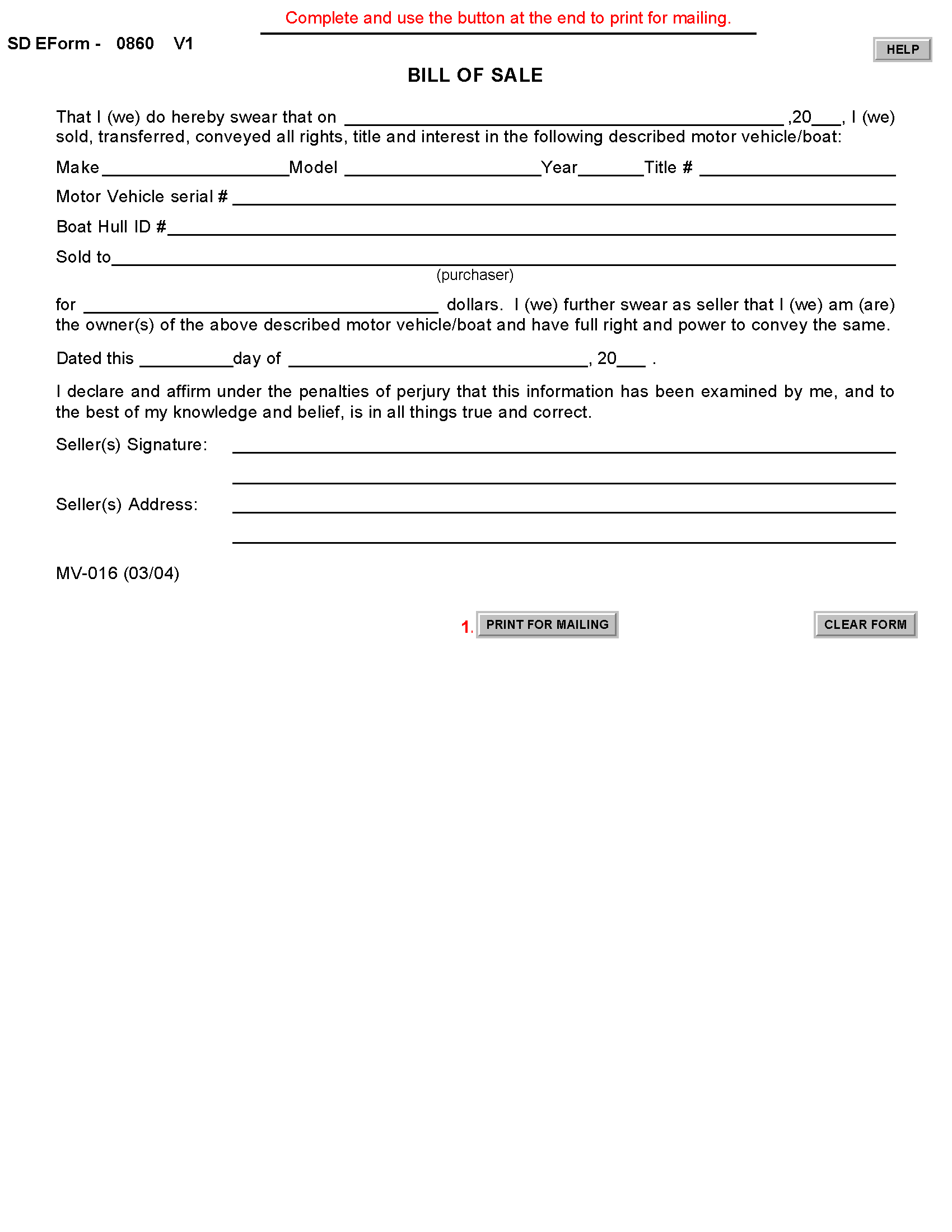

1 June 2018 South Dakota Department of Revenue Motor Vehicle Sales Purchases Motor Vehicle Sales and Purchases. Motor vehicles exempt from the motor vehicle excise tax under. If you want to buy cars South Dakota is among the top ten most tax and fee-friendly places in the US.

Repealed by SL 1990 ch 230 7. The municipal gross receipts tax can. Applicable municipal sales tax motor vehicle gross receipts tax and tourism tax on any vehicle product or service they sell that is subject to sales tax in South Dakota.

South dakota charges a 4 excise sales tax rate on the purchase of all vehicles. If any motor vehicle has been subjected previously to a sales tax use tax motor vehicle excise tax or similar tax by this or any other. Select the South Dakota city from the list of popular cities below to see its current sales tax rate.

South Dakota Taxes and Rates Motor Vehicle Excise Tax Applies to the purchase of most motor vehicles. All car sales in South Dakota are subject to the 4 statewide sales tax. South Dakota has recent rate changes Thu Jul 01 2021.

In addition to taxes car purchases in South Dakota may be subject to other fees like registration title and plate fees. South Dakota has a motor vehicle excise tax fee of 4 percent of the purchase price. Motorcycles cars pickups and vans that will be.

Dyed fuels subject to sales tax are. State Sales Tax plus applicable municipal sales tax applies to the selling price of dyed fuel when it is. Ad Get South Dakota Tax Rate By Zip.

The South Dakota use tax should be paid for items bought tax-free over the internet bought while traveling or transported into South Dakota from a state with a lower sales tax rate. What is the sales tax on a vehicle in South Dakota. Imposition of tax--Rate--Failure to pay as misdemeanor.

The vehicle identification number VIN.

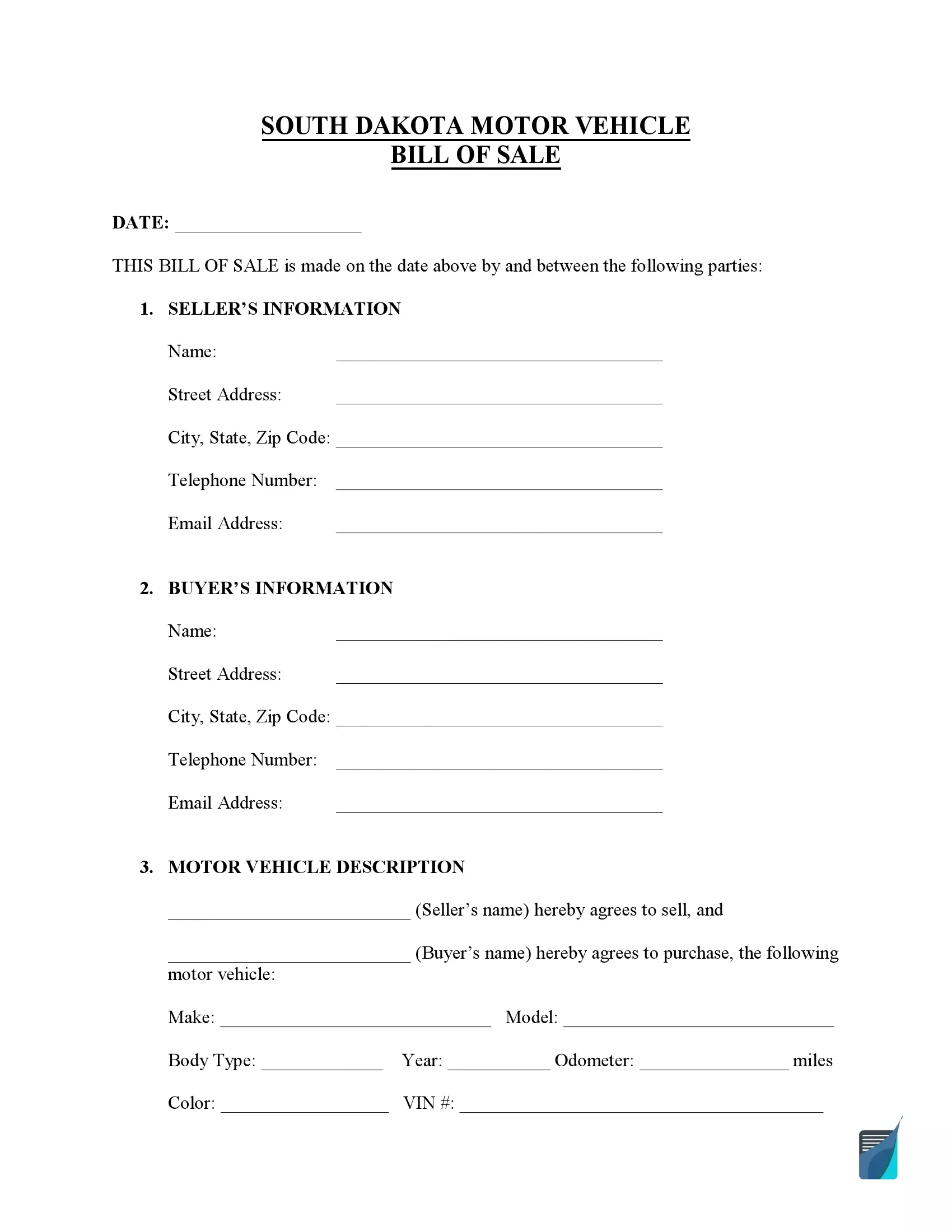

Free South Dakota Vehicle Bill Of Sale Form Pdf Formspal

All Vehicles Title Fees Registration South Dakota Department Of Revenue

South Dakota License Plates Discover Baja Travel Club

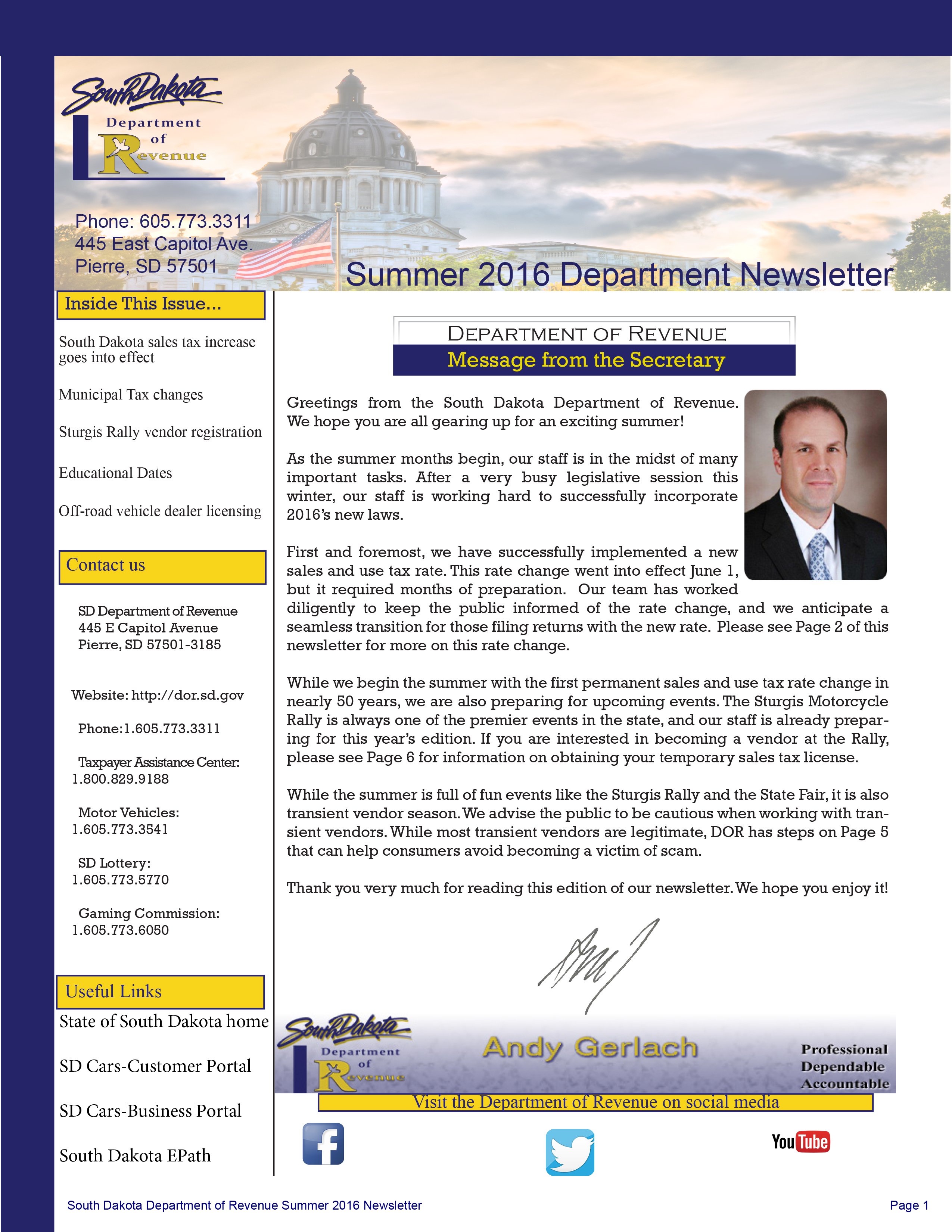

Sales Use Tax South Dakota Department Of Revenue

Rachel Hearn Rache1ynne Twitter

Taxes When Buying A Car Types Of Taxes Payable On A Car Purchase Carbuzz

Ohio Collected 34 9b In State Taxes In 2021 9th Highest In Country Cleveland Com

Sales Taxes In The United States Wikiwand

States With The Highest Lowest Tax Rates

South Dakota Has Demand For Electric Vehicles But Not The Supply Or Energy Grid Sdpb

Free South Dakota Vehicle Bill Of Sale Form Pdf Formspal

South Dakota Motor Vehicle Bill Of Sale Form Download The Free Printable Basic Bill Of Sale Blank Form Tem South Dakota Bill Of Sale Car Bill Of Sale Template

Form Dor Mv215 Fillable Affidavit Of Vehicle Repossession

South Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

South Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

Free South Dakota Motor Vehicle Bill Of Sale Form Pdf Word